Medical Technology Association of India (MTaI), which represents leading research-based medical technology companies with large footprint in manufacturing and training in India, today said that the industry expects the government to address the pending list of asks in the upcoming Union Budget 2024.

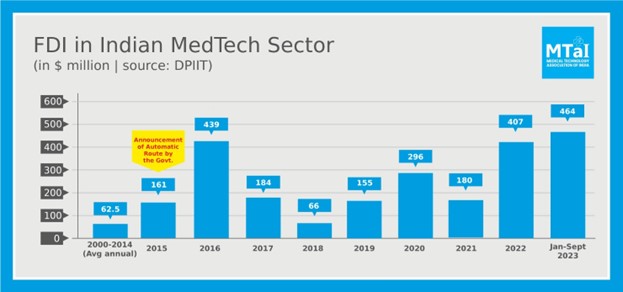

In 2023, the government brought in several new reforms like the National Medical Device Policy (NMDP) and Promotion of Research & Innovation in Pharma MedTech sector (PRIP) with the aim to elevate India’s MedTech industry to become a pathbreaker globally. Efforts undertaken to reduce compliance burdens and create globally harmonized regulations have been welcomed by the industry as already evident from the FDI picture of the first three quarters of 2023. (Chart given below for reference).

There are however hurdles that still continue to restrict the sector from reaching its potential. For example, despite healthcare being a critical segment, it continues to attract very high tariff and customs duty rates and suffers from the imposition of additional health cess ad valorem levied on the sector.

MTaI’s Chairman, Mr. Pavan Choudary said, “It is heartening to see that the government has placed affordability as one of its top priorities. However, the customs duties and taxes levied on medical devices in India are one of the highest in the world and highest among the neighbouring countries which directly impacts patient affordability; this is therefore contradictory to what the government is trying to achieve. As per government data, more than 80% of critical medical devices are imported into India to meet the rising demand for quality healthcare. We hope that as the preparation for the Union Budget 2024 gets underway, a correction on the tariff rates is urgently being considered.”

The issues which need to be addressed in the budget this year are stated in detail below:

- Reduction of High Customs Duties to 2.5% on medical devices: For products where the ability to import-substitute is still some time away; the high customs duty should be reduced. The high customs duty has adversely impacted the costs of medical devices in India which is as stated above counterproductive to governments’ goals.

Additionally, since the custom duty regime on most of the medical devices in many neighboring countries is lower than in India, the difference in duties created could lead to the smuggling of low-bulk-high-value devices. The result will not only be a loss of revenue for the government but also the patient will be beset with products that are not backed by adequate legal and service guarantees.

- Removal of Healthcess ad valorem: The 5% healthcess ad valorem imposed on imported medical devices has further compounded the burden on the industry. India, like any other country that is catering to its healthcare demand fairly well, almost always rely on imports too. Therefore, an additional tax threatens to not only dent the access to advanced medical equipment coming to India but will also leave patients bearing the brunt of these additional costs adding to the inflationary spiral.

- Increase public health spending to meet the healthcare demand-supply gap: As per the recommendations of the Fifteenth Finance Commission, the public health expenditure of the Union and States together should strive to reach 2.5 percent of GDP by 2025. India currently has only 1.3 hospital beds per 1,000 population. An additional 3 million beds will be needed for India to achieve the target of 3 beds per 1,000 people by 2025. A similar gap exists in the availability of treatment services, as up to 60% of health facilities are concentrated in a handful of large cities across the country. Therefore, there is a need for a focussed increase in public spending on health infrastructure especially in Tier 2, and Tier 3 cities and rural areas in the Union budget 2024-25.

- Incentivizing Skilling initiatives to bridge skill gap: At present, there is an acute shortage of skilled healthcare workers, with 0.65 physicians per 1,000 people (the WHO standard is 1 per 1,000 people) and 1.3 nurses per 1,000 people. It is estimated that another 1.54 million doctors and 2.4 million nurses will be required to meet the growing demand for quality healthcare in India due to initiatives like Ayushman Bharat (PM-JAY). To meet this demand, the private sector can be encouraged to take-up workforce skilling activities along with NSDC or HSSC for which tax incentives can be provided. (MTaI members already train more than 2.5 lakh HCWs annually across the country).

- Exemption of free medical device samples from TDS: The guidelines that were issued in June 2022 regarding section 194R of the IT Act meant that even free samples of medical devices would come under the TDS regime. The product samples provided by medical device companies to clinicians, enable them to get hands-on training to learn the optimum usage, application, and handling of the product and sometimes to even demonstrate to the patients on how the procedure will be carried through. These samples are always marked “Physicians Sample not for sale” as per the D&C Act and Medical Devices Rules 2017 and are not to be used to generate any income. Therefore, any taxation on samples will prohibit these activities and hinder the doctor’s ability to deliver optimal patient outcomes.

- Expanding the coverage of government health insurance schemes to include daycare surgeries and home healthcare:

-

- New-innovations in medical technology like Minimally Invasive Procedures, Robotic Assisted Surgery (RAS), etc. have drastically reduced the procedure time enabling hospitals to perform surgeries in hours thereby avoiding patient hospitalization. Such day-care procedures have not only helped the patient who can begin recovery sooner but also reduced bed occupancy time allowing hospitals to serve the next patient sooner and many a time costs the payer less. However, barring a few procedures like cataract, dialysis, etc; procedures that do not require overnight hospitalization are not covered in insurance coverage schemes.

-

- Similarly, homecare should also be encouraged by covering under insurance schemes. Homecare allows the delivery of essential healthcare services like doctor care, nursing care, occupational and physiotherapy to patients at their homes and has been particularly beneficial for senior citizens, the chronically ill, and persons with disability. Coverage of homecare services will benefit both patients and hospitals by reducing the cost of care and by increasing the availability of hospital beds.

Join us on social media

Facebook: @mtaiorg | Twitter: @mtaiorg | LinkedIn: @mtai-india